Having recently read Edward Chancellor’s book ‘The Price of Time’, I wanted to share my reflections by posing the following questions:

What is the link between cows and interest payments?

How do you fund a parmesan cheese business?

What is the time value of money?

What is the price of time and uncertainty?

Are interest rates a natural phenomenon?

Readers may have subscribed to this blog in anticipation of light-hearted commentary on classical literature. Caveat lector! At its core, this particular piece focuses on financial concepts. But I hope readers will not be deterred as I aim to write in a way that allows any curious person to enjoy the pieces regardless of their prior knowledge of the subject at hand.

Let’s begin…

In Principio Erat

In the beginning was the loan, and the loan was with the bank, and the loan carried interest.

Many words related to debt, capital, and interest derive from agricultural terms and specifically from words describing the rearing of livestock. The English word ‘capital’, for instance, comes from the Latin word for a ‘head of cattle’, caput. The Latin for ‘interest’, foenus, is cognate with words for ‘fertility’, like the adjective fecundus, ‘fecund’. Similarly, the Latin word for money, pecunia, is derived from pecus, ‘a flock’, and the Ancient Greek τόκος or tókos means both ‘offspring’ as well as ‘interest’.

Why is that?

Perhaps the answer to our question is best illustrated by a 4,000-year-old Sumerian administrative record:

Discovered at Drehem, in modern-day Iraq, this ancient clay tablet outlines the growth of a theoretical herd of cattle over the course of 10 years. Just like many financial models produced by bankers and analysts today, this Ancient Mesopotamian model relies on wildly optimistic assumptions - no cows ever die and each pair always has a calf. You might call their projections ‘bull-ish’…

The tablet illustrates a scenario that begins with a herd of four cows and projects the growth of that herd through breeding. The document estimates how much milk, butter, and cheese the herd would yield in 10 years’ time and also indicates how much this output would be worth in silver shekels (roughly 30 shekels by my reading of their calculations).

Although stated in hypothetical terms, this tablet depicts the familiar practice of animal husbandry, observable across agricultural societies throughout human history and up to the present day.

So how does this clay tablet and a herd of livestock growing in number relate to our etymological conundrum about debt? A clue lies in the fact that the Sumerian word for 'interest', 𒈧 or máš-, also means ‘the offspring of livestock’ (specifically, goats).

Cow Finance

Even today in rural areas, especially in places where there is only limited access to formal banking, communities often use cattle to preserve their surplus funds.1 Like a savings account, a herd of cows can provide a regular income. Unlike a savings account, this income comes typically in the form of milk (for drinking and making cheese) rather than interest payments; milk, that is, or dung (to use fuel,) or even blood (to drink) if you are a Maasai herdsman.

In these pastoralist societies, cows are often a relatively liquid investment vehicle. In other words, even though you cannot literally withdraw your money from a cow, you can easily sell it, eat it, or turn it into a leather handbag.

Taking this further, we might observe that cows can also be used as a form of interest-bearing debt. If a farmer lends her herd to a neighbour, not only would she expect to get back what she lent — the principal, in this case the cow — but also the income produced by the assets — an interest rate, in this case calves.

In short, the reproductive abilities of cattle and other livestock means that, when lent out to others, they offer an inherent interest rate which may approximate the opportunity cost and the value of the time nature requires for the animals to grow

Even today, anthropological studies record examples of this practice, where communities make loans backed up by a real asset, namely, a cow or herd of cows (termed ‘antichretic’ loans).2

As an aside: If you lived in a community where cows were the basis of most banking and trading, you would most likely be able to use your cow as collateral for an actual loan (not investment advice). In fact, while we are on the subject, you could even go as far as to ‘securitise’ your entire herd of livestock (definitely not investment advice). Securitisation is the process of pooling together and packaging up similar assets into a tradeable security. For a small fee, I will package up your herd of cows into a collateralised debt product, I will split the cashflows (calves) arising from the herd into different tranches of risk-return, and I will sell these securities on to investors. Let's call it a CCO, a ‘collateralised cow obligation’.

Parmesan-Backed Lending

One example of specialist lending against dairy assets is offered by an Italian bank in the Emilia-Romagna region. Since 1953, Credito Emiliano (CredEm), the bank in question, has offered producers of Parmigiano Reggiano cheese the option to use their wheels of Parmigiano Reggiano as loan collateral.

Cheese producers, like wine or cognac producers, face the problem of an extraordinarily protracted ‘cash conversion cycle’ - in other words, there is a very long lag between the time when the producer expends cash on producing cheese inventory and the time when it realises cash revenues and profits from selling the mature cheese wheels. During the term of a ‘parmesan loan’, which is typically the length of time it takes the cheese to mature after initial production, CredEm will hold the producers’ cheese as collateral in its own warehouse. This credit facility enables the cheese producers to both let their inventory mature and continue funding their business operations despite not having realised profits from their initial capital outlays.

The Time Value of Money

Time preference is a core concept in economics and finance. The key intuition to reflect on here is that people place greater value on having money today than having the same amount of money in the future.

Fundamentally, this is because spending money now allows you to consume with certainty. Saving money in a bank account or an investment allows someone else to consume now. The rate of return on those savings or investments is what incentivises and compensates you for deferring your consumption.

Time and uncertainty are the central focus of all investment decisions, in the real economy as well as in financial markets. Money, for example, is an asset that offers instant gratification. Money is always ready to use at a moment’s notice and it offers a degree of certainty since there is no need to convert money into another asset when the time comes to spend it (money is already a fungible medium of exchange), plus, moving money around typically involves minimal to no transaction costs.

As an aside, I explore what is generally meant by the term by ‘money’ in depth here:3

But money also has one serious disadvantage.

Simply put, you can never grow wealthier by holding money under your mattress. What is more, when there is inflation, keeping money under your mattress actually erodes the value of your wealth (in the UK, if you held £100 this time last year (2022), that same money has a buying power closer to £95 today (2023)). The only time when holding cash could grow your wealth is during a period of disinflation - but a disinflationary economy is even more destructive in its own ways. That merits a whole separate analysis, so let’s save it for another time.

The Price of Time & Uncertainty

What factors affect the time value of money and the cost at which you are willing to part with that capital?

Effectively, two key variables must be synthesised together to produce a rate of return that will satisfy a lender of capital: the length of time, and the degree of uncertainty.

First and foremost, this rate of return must reflect the price of time. In saving or investing, we are, in essence, giving our money to someone else to use. The compensation that induces us to part with our money and rewards us for the inconvenience of being without it is a function of time.

So, to offer an intuitive example of the price of time, we should expect to collect a larger sum of interest payments over 30 years than over 30 days.

The second element of this rate of return is compensation for risk. Will we ever see our money again? How long will we have to wait before we do? How much will we be able to buy with it when we do get it back? Was there an alternative use for it that would have worked out better than the one we selected? A combination of the risk profile of the recipient and our own risk tolerance will determine the adequate price to compensate for uncertainty.

Again, to offer an intuitive example of the price of uncertainty, imagine that I were to lend money to two individuals. The first individual has held down a steady job for many years, while the second individual has no source of income and a gambling habit. Given their respective credit profiles, the first individual is more likely to pay back the loan. In other words, the loan involves less risk, so I offer them a lower rate of interest. The gambler, meanwhile, is a riskier bet, so I require a higher rate of interest to compensate for the risk that they will not repay principal value of their loan.

All saving and investment decisions involve parting with cash and therefore involve these two prices.

The Cost of Capital

How can we calculate the price of time and uncertainty?

In finance, the way market participants most often approximate the price for the time and uncertainty is with a rate of return known as the ‘cost of capital’, more specifically, the ‘weighted average cost of capital’ (WACC).

The cost of capital is the rate of return at which an investor is willing to provide money to a borrower. The cost of capital takes us from a present value to a future value. Its converse is the discount rate, which takes us from a future value to a present value. Expected returns come with varying degrees of certainty, but in all cases a single number reflects a distribution of potential outcomes.

The cost of capital is based on the economic principle of substitution. An investor will not invest in an asset if a comparable asset exists that is more attractive, including consideration for risk. This means that an investor will buy the asset with the highest return for a given level of risk, or the lowest risk for a given level of return. This presumes that more risk is associated with more reward.

The cost of capital varies over time. Periods when the cost of capital is high are followed by periods of returns that are above normal, on average, and a low cost of capital tends to precede subpar returns. Over the last decade, for instance, we have experienced an extraordinarily low cost of capital that has in the last year begun to trend higher once again.

Finally, the cost of capital depends on the sources of capital. To draw our discussion here to its conclusion, it is simplest to focus on the cost of capital for businesses (rather than individuals) and to examine the two forms of capital most frequently accessed in the financial markets; namely, debt and equity.

In order to arrive at a cost of capital for a given proposition, we must input each of its constituent parts. In the most simplistic formulation, these are:

The cost of debt; and

The cost of equity.

Typically, this is expressed as a ‘weighted average’, or WACC, because, when calculated, it accounts for the relative proportion of funding from each source of capital:

WACC = (cost of debt × weighting of debt) + (cost of equity × weighting of equity)

If of interest, the calculations of these are explored further below after the conclusion, in Appendices 1-3.

Cowshed Revisited

Returning to our herd of cattle, are there any inferences we can draw from our cows in relation to the cost of capital?

The conclusion that I am most inclined to draw out is that the cost of capital may well have its origins in the natural world.

Etymological echoes reflect the fact that the concept of an interest rate likely derives from biological rates of reproduction in nature. I cited livestock, but the sowing and harvesting of grain would serve equally well as an analogy and has its own etymological echoes across ancient languages.

As a closing thought - the fact that there is a sort of rate of return built into the natural world may explain why the recent phenomenon of negative interest rates experienced over the last few years has seemed such a deeply perplexing and unnatural aberration to most observers. That is perhaps a subject for another time.4

Bibliography

The Price of Time: The key source of inspiration for this piece (and its title) is the most recent book written by investor and financial historian Edward Chancellor:

The Price of Time: The Real Story of Interest, Edward Chancellor (2022), Atlantic Monthly Press, FT Review

You can listen to Edward speaking about the book on The Library of Mistakes, Super Investors, and Masters in Business.

A History of Interest Rates, Fourth Edition, Sidney Homer & Richard Sylla (1963, 2005), Wiley Finance

The above text is Chancellor’s primary source and a more academic treatment of the same subject. Do not be put off by the dry title, it is a captivating and magisterial read. Homer and Sylla also have admirably classical-sounding surnames.

Puzriš-Dagan Tablet: Gavin Jackson writing in the FT originally put me on the trail of the particular Sumerian tablet discussed in this piece, although interestingly he misconstrues the meaning of 𒈧/ máš- as ‘calf’. My reading for that section of the essay included:

A Reconstruction of the Puzriš-Dagan Central Livestock Agency, Christina Tsouparopoulou, Max Planck Institute for the History of Science, Cuneiform Digital Library Initiative

What We Learn about Money from Sumerian Cattle Farming, Gavin Jackson (2022), Financial Times

The Growth of a Herd of Cattle, Kathryn Kelley, Oxford University, Cuneiform Digital Library Initiative

The Cost of Capital: Michael Mauboussin writes most lucidly and clearly on this subject. His series entitled ‘Consilient Observer’ are invariably superb and the primer on the cost of capital is a particular tour de force:

Cost of Capital: A Practical Guide to Measuring Opportunity Cost, Michael Mauboussin & Dan Callahan (2023), MSIM Consilient Observer, Counterpoint Global Insights

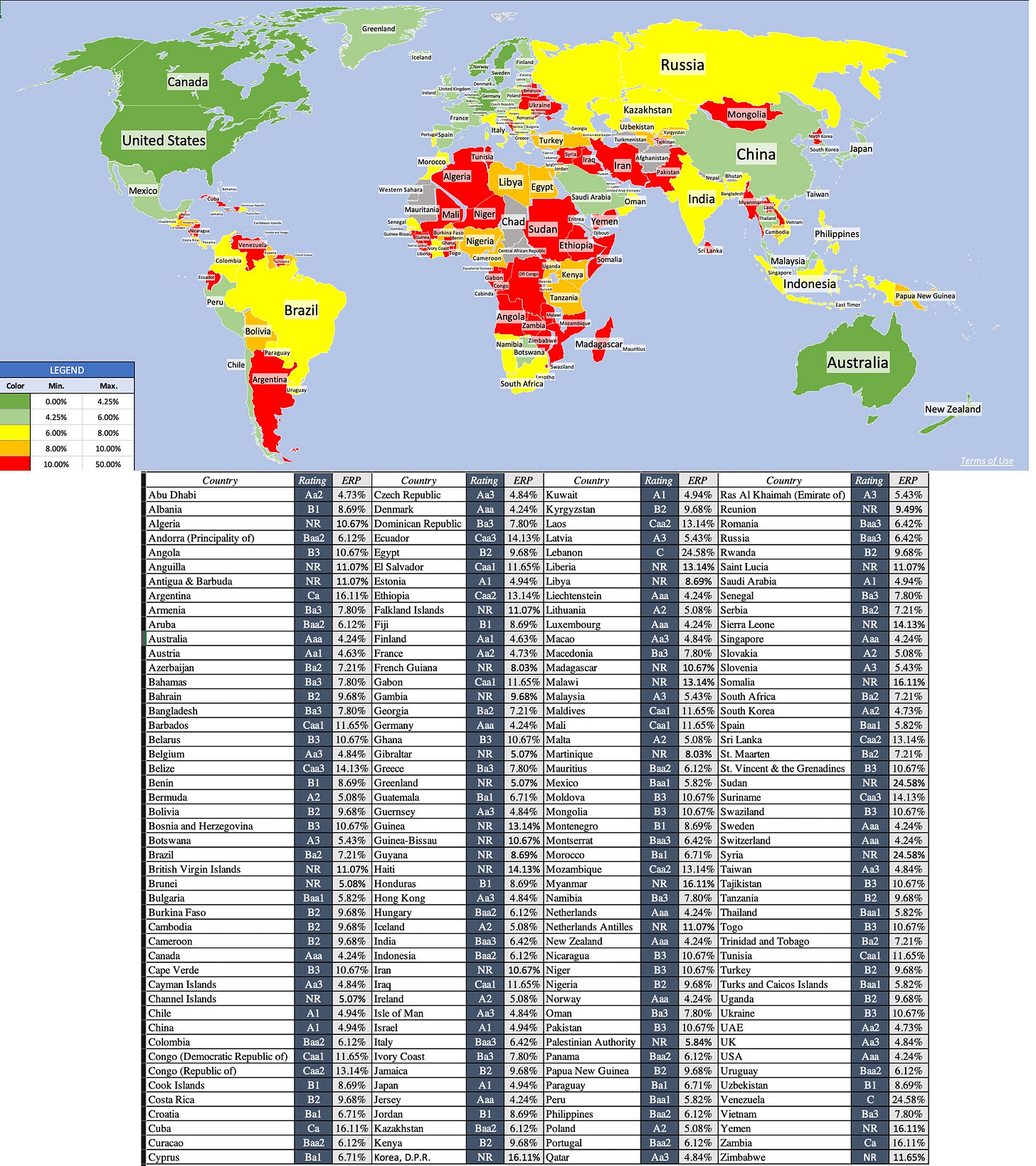

Sumerian, Equity Risk Premia, and Inflation Data Sets:

Current Data, Aswath Damodaran (2023), NYU Stern

Inflation Calculator, Bank of England

The Open Richly Annotated Cuneiform Corpus, ORACC

Parmigiano Reggiano: Surprisingly, I was alerted to the existence of parmesan loans by a TikTok.

Appendix 1: Calculating the Cost of Debt

The aim of any given company is to raise capital to use in the business and earn a return in excess of the cost of that capital.

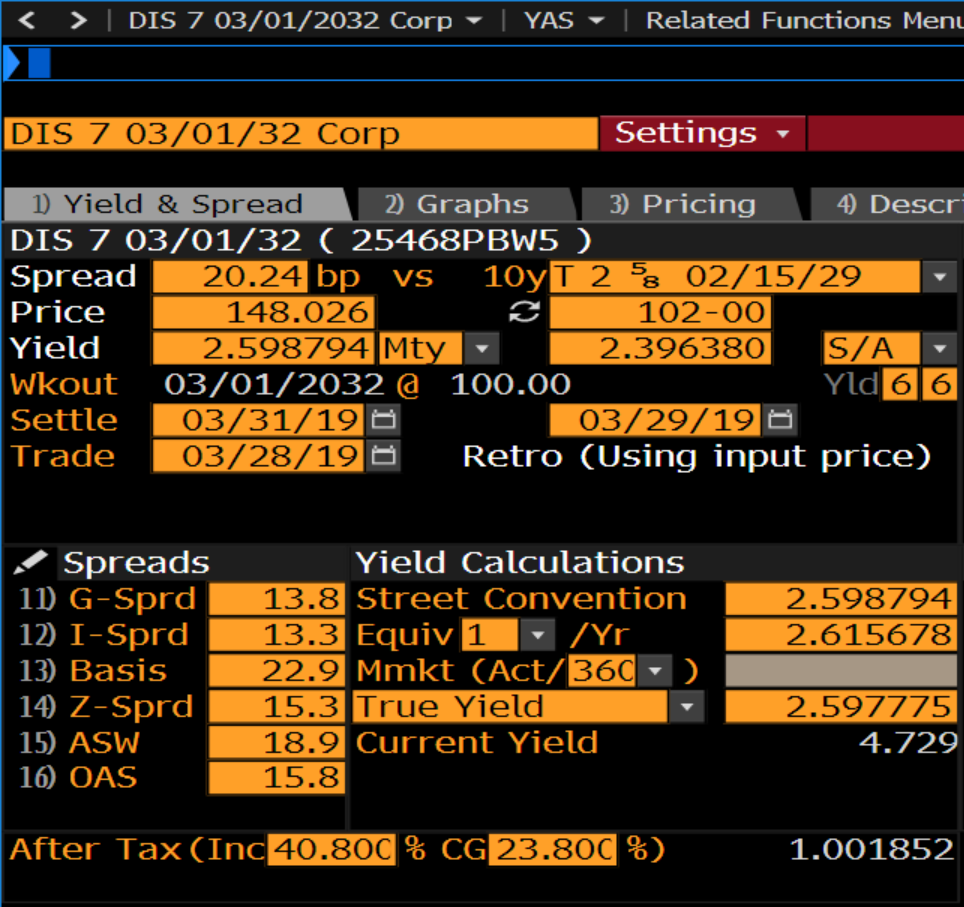

The cost of debt is the effective after-tax rate a company has to pay on its long-term debt. Estimating the cost of debt is relatively straightforward because the details of the agreement between the company and the investor are stated plainly in a contract document.

Investors may disagree with the market's assessment of a bond price but the company's obligations are in plain view. The price of the debt can vary over time as it is effectively an estimate of the likelihood that the debtor will default on their obligations at any given time. The terms of debt financing, on other hand, such as the magnitude and timing of cash flows, are established definitively by the contract.

Generally speaking, the expected risk and return are lower for debt holders than for equity holders. This is because debt has a senior claim on cash flows, in other words, debt holders get paid before equity holders do.

The yield-to-maturity (YTM) on a company's long-term, option-free bonds is a good estimate for the pre-tax cost of debt for a company with securities that are rated as investment grade. Investment grade refers to debt that is deemed to have a relatively low risk of default. (For riskier companies that have only short-term or illiquid debt, it is necessary to estimate the cost of debt indirectly using other similar publicly-traded debt as a proxy).

One quirk of funding a business via debt financing is that, in almost all jurisdictions, companies are able to recognise their interest expenses as a deduction from taxes - in other words, interest is tax deductible. This means that it is necessary to make a tax adjustment when calculating the cost of debt, taking debt from a pre-tax rate to an after-tax rate to reflect the marginal tax rate for the entity in question (the marginal tax rate being the tax rate an entity pays on its next £ of taxable income):

(after-tax) cost of debt = (pre-tax) cost of debt * (1 - marginal tax rate)

Appendix 2: Calculating the Cost of Equity

The cost of equity is the expected total return on a company's stock. An estimate of the cost of equity should never be lower than that of debt. You can think of equity as a residual claim, or what's left over after subtracting the claims of debt holders and preferred shareholders. Companies that earn a return on investment in excess of the cost of capital create value for shareholders because other claims have been satisfied and the additional value accrues to the equity holders.

Estimating the cost of equity is more difficult because we cannot observe it directly. When a company issues debt the obligations are stated in a contract, but when a company issues equity none of the determinants of value are explicit. Dividends, for instance, which somewhat reflect the magnitude and timing of cash flows, are at best a quasi-commitment to return cash to shareholders.

Therefore, it is necessary to make an estimate of the cost of equity. The most common approach used by market participants to assess the cost of equity is known as the ‘capital asset pricing model’ (CAPM). Although imperfect, CAPM, especially with methods to reduce the error in beta, is a useful shorthand for calculating the cost of equity.

The CAPM estimates the expected return of a security by adding the risk-free rate to the security's beta (β) times the equity risk premium (ERP).

CAPM = risk-free rate + β * (market return - risk-free rate)

Risk-Free Rate. The best proxy for the risk-free rate is a yield on a long-term, default-free government fixed income security. The yield on the 10-year U.S. Treasury note, for instance, is appropriate for businesses based in the United States. This yield is easy to find, is sufficiently long-dated, and has a relatively low risk of default.

The Equity Risk Premium (ERP) equals the difference between the expected return for the market and the risk-free rate and is similar conceptually to a credit spread. It expresses the additional ‘systematic’ (i.e. market-wide) risk of holding equity versus the risk-free rate and so has often been termed the ‘fear premium’. The ERP is higher than credit spreads in general because equity is riskier than debt.

Equity risk premium = Market return - Risk-free rate

Mauboussin: “There are three common approaches to estimating the ERP. The first is to look at historical results and assume the future will be similar to the past. The second is to survey investors about their expectations. The third is to estimate a rate the market implies by reverse-engineering assumptions to solve for the market price. Each approach has its pros and cons. Historical results are supported by lots of data but are highly sensitive to the time period selected, include survivorship bias, and are different whether calculated using arithmetic or geometric averages. Surveys, which include forecasts by academics, financial executives, and individual and institutional investors, provide snapshots of attitudes at a specific moment but are imperfect because of a strong tendency to extrapolate recent results. The structures of the surveys are not always ideal. An ERP implied by the market uses current prices but requires forecasts for drivers such as cash flow growth and return on capital.”

It should be noted that the CAPM is not universally well-regarded. The focal point of controversy is beta.

Beta (β) is an estimate of the sensitivity of a stock's returns relative to those of the broader stock market by measuring the return of an individual security relative to the return on the market index. You calculate a historical beta by doing a regression analysis with the market's total returns as the independent variable (x-axis) and the asset's total returns as the dependent variable (y-axis). The slope of the best-fit line is the beta.

Mauboussin: “Despite the CAPM's popularity among practitioners, the concept of beta has been challenged on empirical and intellectual grounds. The empirical problem is that beta does not predict expected returns the way it is meant to. Specifically, stocks with low betas generate higher returns, and stocks with high betas deliver lower returns, than the model predicts. The intellectual objection is that volatility in general, and beta in particular, are poor ways to measure risk. Value investors generally define risk as potential permanent loss of capital and argue that the volatility of asset prices does a poor job of capturing that risk. Calculating beta requires a number of judgments. These include which index to compare to, how far back in history to go, and whether to measure frequency on a daily, weekly, monthly, quarterly, or yearly basis. Another way to improve beta is to use an industry beta rather than the beta of an individual company. The economic rationale is that business risk, or variability of cash flows, will be similar for all companies within an industry. An industry beta can reduce error by using a larger sample, potentially cancelling the noise that appears in the estimation of beta for individual companies. The predictive value of beta improves when past returns are winsorized. Winsorizing removes extreme values in a data series to reduce the impact of nonrepresentative outliers.”

To summarise this section, the most reliable approximation for calculating the cost of equity is to use:

The 10-year Treasury note as the risk-free rate

An equity risk premium that looks forward, and

A 60-month, monthly beta that is adjusted as appropriate.

Estimates for the cost of equity should also be checked by examining other forms of risk priced by the market.

Appendix 3: The Weighted Average Cost of Capital (WACC)

The weighted average cost of capital (or ‘WACC’) blends the opportunity cost of the sources of capital with the relative contribution of those sources to determine the rate at which you discount future cash flows in order to determine the value today. A company's optimal capital structure finds the trade-off between the financial benefits of debt and the risk of financial distress that maximises the value of the firm.

WACC = (cost of debt × weighting of debt) + (cost of equity × weighting of equity)

Weighting of debt and equity should be based on market values and not book values. The reason is that opportunity cost is based on the prevailing asset price rather than the level at which the company reflects debt or equity on the balance sheet. Some companies, for instance, can have negative equity as the result of accounting standards.

It is worth noting that the above equation is somewhat more hypothetical and simplistic than what often appears in practice. In particular, the WACC may need to incorporate other forms of financing besides equity and debt, including convertible bonds and preferred equity. That said, these are invariably small relative to straight debt and equity.

The Role of Livestock in Developing Communities: Enhancing Multifunctionality, Frans Swanepoel, Aldo Stroebel & Siboniso Moyo (2010), Consultative Group on International Agricultural Research

Antichresis Leases: Theory and Empirical Evidence from the Bolivian Experience, Ignacio Navarro, Geoffrey K. Turnbull (2010) Regional Science and Urban Economics

In summary, the term ‘money’ refers to both physical money, such as ‘commodity money’ like coins or ‘representative money’ like banknotes, as well as digital money, such as ‘commercial bank money’ like bank deposits or ‘central bank money’ like the reserves held by commercial banks at the central bank. Personally, I use the word ‘cash’ synonymously and interchangeably with the word ‘money’.

Postscript: For which, please refer to my quantitative easing series

Quantitative Easing & Tightening

This week’s topic is drawn from a vintage that may not appeal to some readers’ palates. Today, I would like to consider the form of monetary policy called ‘quantitative easing’. Known to friends as ‘QE’, it also goes by the sobriquets ‘loose’ and ‘unconventional’. It is best conceptualised as ‘asset purchase programmes’, but can be considered a form of m…